Information about Saral Cash Credit & EMI Scheme

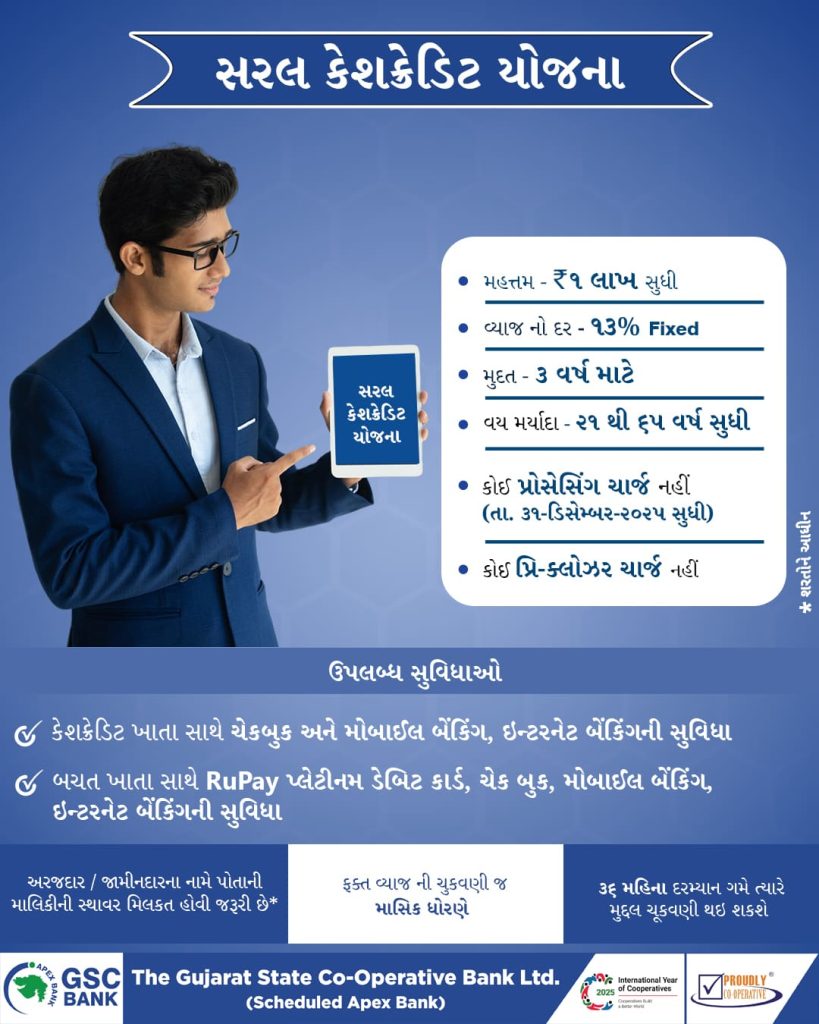

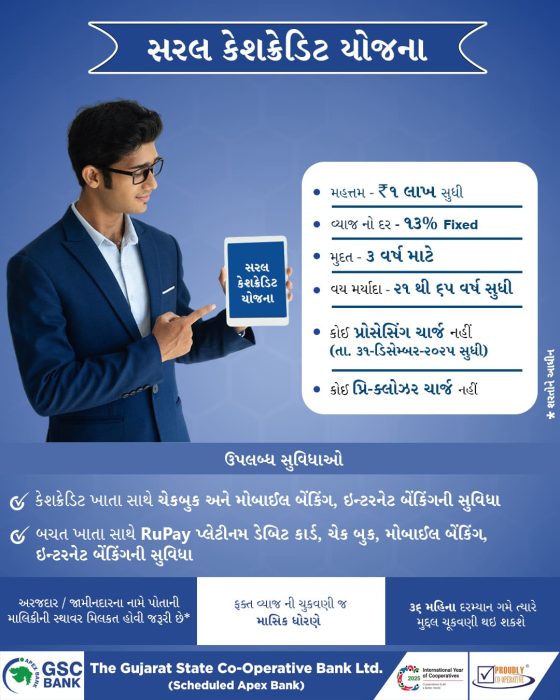

The Bank has launched “Saral Cash Credit Scheme” for its customers located within the jurisdiction of the Bank. The said scheme will empower the customers, to avail the said cash credit facility quickly and easily. The main points of the Saral Cash Credit facility is as under –

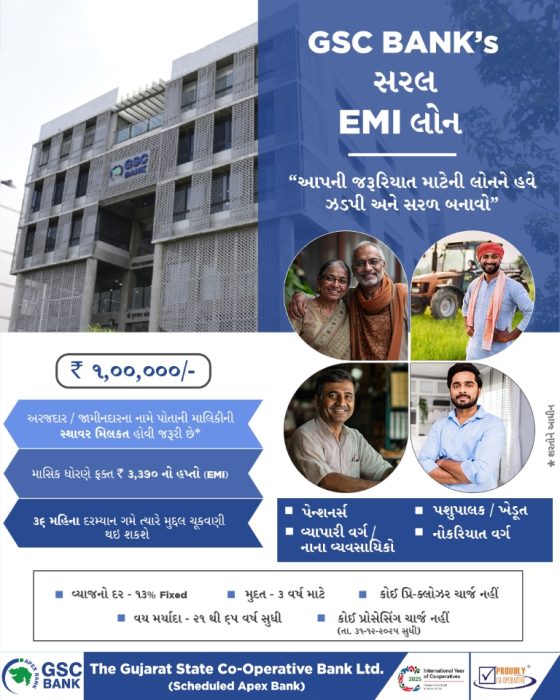

The Bank has launched “Saral Cash Credit EMI Scheme” for its customers located within the jurisdiction of the Bank. The said scheme will empower the customers, to avail the said cash credit facility quickly and easily. The main points of the Saral Cash EMI Credit facility is as under –

The main points of the scheme are as follows: |

|

| Maximum Loan – Up to Rs. 1 Lakh – which will be unsecured | Interest Rate – 13% fixed |

| Applicant’s age limit – 21 to 65 years | Term – For 36 months – Subject to review every year |

| Processing Charge – NIL (Till 31 December 2025) | Interest Payment – Monthly basis – from 1st to 10th |

| Cash Credit Account with cheque book, mobile banking and internet banking facility. | Savings Account with RuPay Debit Card, cheque book, mobile banking, and internet banking facility. |

| The applicant must own the immovable property, if not then it is necessary to take guarantor who holds own immovable property. | There will be no charge for CIBIL report as well as no pre-closure charges. |

| Interest payable on monthly basis | |

The main points of the scheme are as follows: |

|

| Maximum Loan – Up to Rs. 1 Lakh – which will be unsecured | Interest Rate – 13% fixed |

| Applicant’s age limit – 21 to 65 years | Term – For 36 months – Subject to review every year |

| Processing Charge – NIL (Till 31 December 2025) | Interest Payment – Monthly basis – from 1st to 10th |

| Cash Credit Account with cheque book, mobile banking and internet banking facility. | Savings Account with RuPay Debit Card, cheque book, mobile banking, and internet banking facility. |

| The applicant must own the immovable property, if not then it is necessary to take guarantor who holds own immovable property. | There will be no charge for CIBIL report as well as no pre-closure charges. |

| Monthly installment (EMI) of only approximately 3,370. | |

Accounts

Accounts

Loans

Loans

Lockers

Lockers

Services

Services Digital Banking

Digital Banking

Insurance

Insurance

Interest Rates

Interest Rates Offers

Offers Important Links

Important Links